Template Name

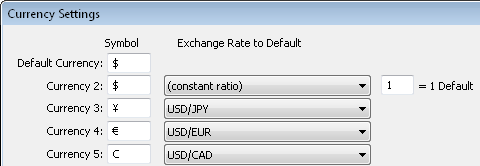

USD Default

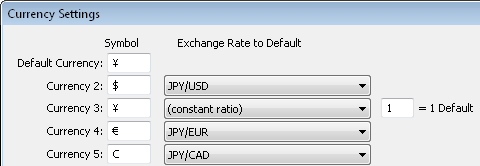

JPY Default

EUR Default

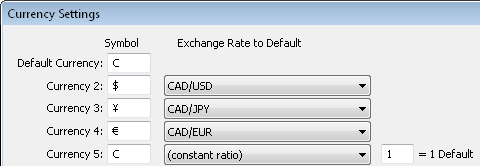

CAD Default

This dialog is available from the Options / Currency Settings... menu command.

Fund Manager supports tracking investments in multiple currencies. To see a tutorial with step by step instructions on setting up Fund Manager to track multiple currencies, visit: https://www.fundmanagersoftware.com/tutor_currency.html

This dialog box allows you to customize the displayed symbol for each currency as well as the exchange rates from each currency to the default currency. These settings are memorized in portfolios. Fund Manager supports tracking investments in up to 25 different currencies. One of the 25 currencies is the "Default" currency.

Symbol:

For each currency a 'Symbol' can be assigned to represent the associated currency. Each currency, including the default currency, can be assigned its own unique symbol.

Exchange Rate to Default:

For all currencies, besides the default currency, an 'Exchange Rate to Default' can be specified. This is how Fund Manager will adjust non-default currencies to the default currency when the menu command View / Exchange Rate Adjusted is toggled on. When View / Exchange Rate Adjusted is off, each investment is displayed in its native currency.

The exchange rate can either be specified to be a constant ratio, or an investment can be assigned as the exchange rate for this currency:

Constant Ratio:

When a constant ratio is specified an additional edit box will be available to input this ratio. This ratio will be used for all dates when adjusting the currency to the default currency. As an example, assume that the default currency is the dollar and you have other investments in yen to track. Also assume 1 dollar is equal to 100 yen. You can assign a constant ratio of 100 for the yen currency (100 yen = 1 Default). This means that when View / Exchange Rate Adjusted is turned on, investments in the yen currency will be divided in value by 100, such that they are exchange rate adjusted to the default currency, dollars. Ratios can be any value except 0.

Exchange Rate Investment:

When an investment is assigned to be the exchange rate, the closing price of that investment for each date will be used as the exchange rate. This allows more precise adjustment of each currency to the default currency, as this provides date specific exchange rates. An example of the intended use would be: Create a new investment for each non-default currency in a portfolio. These investments would typically own zero shares, such that their value remains zero. Assign these investment to be the exchange rates for their associated currency. These investments will be used to track the exchange rate as a function of time. To track the exchange rates, update each exchange rate investment's closing price with the exchange rate for its associated currency for that date.

If all of the investments being tracked are in a single currency (which may be the case for many investors), just use the default currency for all of the investments. Currency settings besides the default currency symbol can be disregarded in this case.

All price and transaction data is always entered and imported in the native currency of the investment, independent of the state of View / Exchange Rate Adjusted. However, when exporting prices, value, or transactions to a text file, the data are exported according to the current state of View / Exchange Rate Adjusted.

Investments assigned to an exchange rate and investments of type "Exchange Rate" are not adjusted with View / Exchange Rate Adjusted. It is recommended to assign such investments to the default currency, so that if/when they are included in a report, they do not cause (na) values due to summing across currencies.

Own zero shares in investments assigned to be an exchange rate.

Place investments assigned to be an exchange rate in their own sub-portfolio, separate from your actual holdings. This allows reporting on your actual holdings, without seeing the exchange rate investments included in your reports.

When viewing monetary values that are not in a single currency the currency symbol "(na)" will be used to indicate Not Adjusted. For example, this is the situation when viewing a portfolio value of investments in multiple currencies with View / Exchange Rate Adjusted turned off.

When importing transactions, you can have Fund Manager automatically separate your investments into sub-portfolios by currency. See the option "Put Investments of Non-Default Currency in Separate Sub-Portfolios" in the New Investments Options Dialog.

Global Versus Transaction Specific Exchange Rates:

This dialog specifies the "global" exchange rates between all currencies and the default currency. In addition to these global exchange rates, transaction specific exchange rates can also be recorded. Buy, Sell, and Distribution transactions (in investments not assigned to the default currency) can optionally have a transaction specific exchange rate. Transaction specific exchange rates will be used to exchange that transaction's values to the default currency. If no transaction specific exchange rate is recorded, the global exchange rate specified in this dialog will be used instead.

Transaction specific exchange rates are particularly useful when an investment is not in the default currency, but the default cash account is in the default currency. Transaction specific exchange rates in this case helps ensure the proper amount of cash is debited/credited due to recording of an automatic corresponding default cash account entry.

Currency templates remember a complete particular set of currency settings. Currency templates can be used to quickly switch your currency settings between commonly used configurations. Currency templates can be useful for displaying all your investments adjusted into various default currencies. To use currency templates, assign all your investments to currencies in the "Currency 2" to "Currency 25" range, and do not use the "Default Currency" for the property of any of your investments. Define different currency templates where you leave the currency symbol for Currency 2 to 25 un-changed, and change the default currency as well as the exchange rate rules to that default currency. For example:

|

Template Name |

Currency Settings |

|

USD Default |

|

|

JPY Default |

|

|

EUR Default |

|

|

CAD Default |

|

Notice how in the above examples, the currency symbols for Currency 2 - 5 were not changed. Only the default currency symbol and the exchange rate to default rules were changed.

To create a new currency template, use this Options / Currency Settings... dialog to assign the currency options you want, and then press the Template... button. Choose Edit Template List... and then press New... to assign the current currency settings to a new template name. To quickly change currency templates press F11 on your keyboard to select from the list of defined currency templates, or use Ctrl/Shift + F11 to scroll to the previous/next template. The previous/next template order is based on sorting the template names alphabetically.

When using transaction specific exchange rates you would generally not also utilize currency templates. Transaction specific exchange rates are recorded against only a single default currency, so changing that default currency would make the transaction specific exchange rates invalid. If you are only concerned about looking at items like market price/value, and aren't factoring in transaction costs, you could temporarily use currency templates, realizing that your transaction specific exchange rates will make the associated transaction cost calculations incorrect while the default currency has been changed from its original value.

Gain Due To Market Appreciation Versus Exchange Rate