Report Screen Shots

| The following screen shots demonstrate some of the reporting

capabilities of Fund Manager. Fund Manager has 21

different report types. One of these is the "Custom"

report, where you can choose your own columns from a wide

variety of available fields. Reports can be sub-totaled

by: Sub-Portfolio, Investment Type, Symbol, Asset Type,

Investment Goal, Sector, or Currency. Reports can also be filtered

by Investment Type, Symbol, Asset Type,

Investment Goal, Sector, or Currency. Graph screen shots

are also available. To

read more details on any graph or report type, see the

documentation.

|

| Quick Jump: |

|

|

¹ = Advisor version only

² = Professional/Advisor versions only |

| Portfolio Value report listed by Investment |

| This report shows the value of each investment in the "Jones

Family" portfolio. Reports can be listed by

"Investment", "Symbol", "Investment Type", "Asset Type", "Investment

Goal", "Sector", or "Currency". [read more] |

| Portfolio Value report sub-totaled by portfolio

with a disclaimer |

| Customizable disclaimers can be displayed in the

report's footer (Advisor version only). [read

more] Reports can be displayed flat, or sub-totaled by

Sub-Portfolio, Investment Type, Symbol, Asset Type,

Investment Goal, Sector, or Currency. This report is sub-totaled by Sub-Portfolio. You can have any

number of sub-portfolios, and they can be hierarchical. You can create

a report for any sub-portfolio, anywhere in the sub-portfolio hierarchy.

For example, you could create a report for just the "Janus"

sub-portfolio, and it would include the "Non-Retirement" and

"Retirement" sub-portfolios beneath "Janus", but it would not

include the "TD Ameritrade" sub-portfolio. [read

more] |

| Portfolio Performance |

| This report shows how well your invested money has

performed over the specified time period. Reports can be displayed

for any desired time period, and you can optionally have multiple date

ranges displayed within a single report. The "Yield"

column is the time and money weight Return On Investment (ROI)

yield. [read

more] |

| Portfolio Performance sorted by Yield |

| Reports can be sorted by any displayed column, and

can be displayed in either ascending or descending order. This

report was sorted in descending order by the Yield column. |

| Portfolio Performance listed by Asset Type |

| This demonstrates listing a report by "Asset Type", rather

than "Investment". Reports can be listed by Investment,

Symbol, Investment Type, Asset Type, Investment Goal, Sector, or

Currency. |

| Investment Performance |

| This report type displays the performance of the

underlying investments in your portfolio. The figures are based on

the share price of the investments, so you can see how well the

intrinsic investments performed, independent of when your money was

invested. The 'Return' column displays the true

Time-Weighted Return (TWR) of each investment, and the whole

portfolio. [read more] |

| Executive Summary |

| This report type displays a high level overview of an

account, along with a comparison to any set of indices you

select. The 'Portfolio Activity Summary' section shows the

starting balance, any money added or taken out, the gain/loss

and the ending balance. The 'Portfolio Allocation' pie

chart can be customized to display by top holdings, symbol,

investment type, asset type, investment goal, sector, sub-portfolio, or

currency. The 'Portfolio Performance Summary' section

shows Return on Investment (ROI) yields for the portfolio for

time periods you select. The 'Index Performance Summary'

displays Time-Weighted Returns (TWR) of the indices for the same

time periods, so a comparison can be made to the actual

portfolio returns. You can optionally insert comments and

plot any portfolio based graph. You can insert your own image to be

used as a logo on reports, as shown in this sample. Logos

can be displayed in the upper left and/or upper right corners. [read more] |

| Invoice |

| This report displays like a letter, with an optional

management fee summary along the bottom. The letter text

can be specified in the Report Preferences - Invoice Dialog.

A wide variety of fields can be inserted into the message text.

These fields are substituted with the appropriate values when

displaying the report. [read more] |

| Management Fees |

| This report is available in the Advisor version and displays

management fee details for each client. The advisor can

define any number of management fee methods and rules for

calculating the fees, and then assign this fee method to each

client's sub-portfolios. The report can optionally be

sub-totaled by client (as shown), or listed flat. Like all

reports, this report can be exported to a CSV file for

transmitting fee information to your broker/dealer. [read more] |

| Custom report |

| The custom report is the most flexible report in Fund

Manager. You can choose from a wide variety of available fields, and

display any columns you want, in any order. As with all reports,

you can adjust the title to display whatever you like. You can

also memorize any report, so it can be recalled easily. In

the Professional/Advisor versions you can define your own fields

using existing fields and equations. [read

more] |

| ROI Yield report listed by Investment Type |

| This report calculates the ROI yields. ROI

yields factor in the time value of money, and how/when you invested.

The yield terms are adjustable. Yields can be calculated

for any investment, symbol, investment type, asset type,

investment goal, sector, currency, or sub-portfolio. By default, yield terms

less than 1 year are not annualized, and yield terms greater

than 1 year are annualized, but these are both adjustable. [read

more] |

| Time-Weighted Return report listed by

Investment |

| This report calculates the true Time-Weighted Returns (TWR).

Time-Weighted returns ignore when

you added or removed money, so you can see how well the investments

and portfolio

performed, without considering your market timing. For an

explanation of the differences between ROI and TWR yields, see

Yield Calculations in the

documentation. [read more] |

| Distribution Summary report |

| This report summarizes all the distributions received during

the report period. Fund Manager tracks 13 customizable

distribution types. (Only 4 are shown in this screen

shot). By default this report displays all distribution

types actually received. [read more] |

| Capital Gains report |

| Fund Manager makes tax time easy, by calculating

everything you need for capital gains reporting. Fund Manager

supports the First In First Out (FIFO), Average Cost (AVG), or Specific

Lot accounting methods. Capital gain information can be exported

to a Tax eXchange Format (TXF) file for importing into popular tax

preparation software. [read more]

The Professional and Advisor versions of Fund Manager

also support wash sales. [read more] |

| Open Lots report |

| This report lets you quickly see the status of all your

currently owned shares. The displayed columns can be

customized to view a variety of information on these shares. [read more] |

| Asset Allocation report |

| This report lists each asset type, and gives a summary of

how well it performed over the specified report period.

Each investment is assigned as percentages into one or more

asset types. Asset type assignments can be automatically

retrieved from the internet. There are 100 available asset types, and you can customize their names. [read

more] |

| Investment Goal Allocation report |

| This report lists each investment goal, and gives a

summary of how well it performed over the specified report period.

There are 100 available investment goals, and you can customize their

names. [read more] |

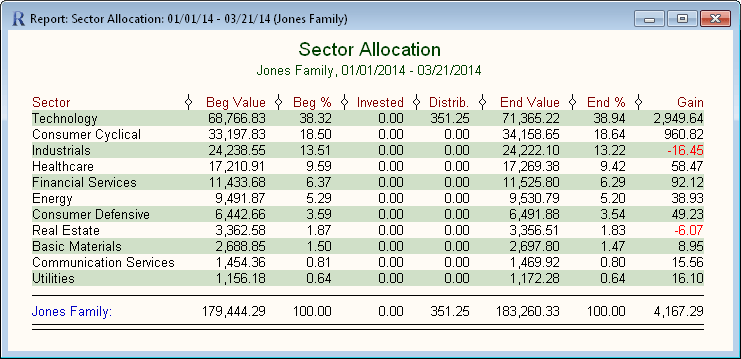

| Sector Allocation report |

| This report lists each sector, and gives a

summary of how well it performed over the specified report period.

Sector assignments can be automatically retrieved from the

internet. There are 100 available investment goals, and you can customize their

names. [read more] |

| Rebalance report |

| This report compares your current allocations to specified

targets. Portfolios can be rebalanced against Asset Type,

Investment Goal, Sector, Investment Type, Currency, or a Model

Portfolio. You can

define your own preferred targets. [read more] |

| Bond Summary report |

| This report displays information on your bond investments.

A wide variety of bond related fields are available.

Select your desired report columns under "Options / Report

Preferences... / Bond Summary". [read more] |

| Income Schedule report |

| This report displays expected interest payments from your

bonds. It can also optionally display scheduled dividend

income. All reports can be sorted by any displayed column,

in either ascending or descending order. This sample

report is sorted by Date. [read more] |

| Monthly Performance report |

| This report gives you insight into how well your invested

money performed each month. The selected performance

metric is reported for the sub-portfolio on a monthly basis.

Totals for each year, and averages are also reported.

Available performance metrics for this report include ROI yield,

Time-Weighted Return (TWR), % Gain, Gain, or Value. [read more] |

| Seasonality report |

| This report shows the relative performance of investments and portfolios for each month of the calendar year.

The performance is averaged over the specified number of years.

There is also a Seasonality graph.

[read more] |

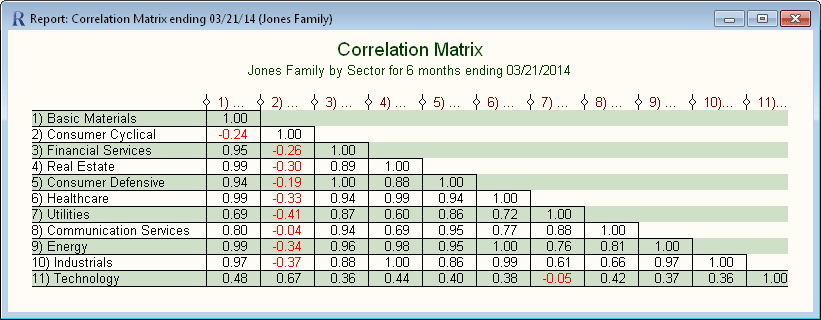

| Correlation Matrix report |

| This report shows a correlation matrix of the monthly

returns between different groups in your portfolio. The matrix

can be displayed for the following groups: Asset Type,

Investment Goal, Sector, Investment Type, or Currency. The

correlation matrix can be calculated for any number of months,

and ending on any date. The correlation coefficients can

vary between -1 and 1. A value of 1 indicates the two

groups are perfectly matched. A value of -1 indicates they

are perfectly matched, but in a negative manner (when one goes

up, the other will go down with the same strength). A

value of 0 indicates there is no relationship between the

groups. [read more] |

| Investment Transactions report |

| This report displays all of your transactions.

It can be set to display transactions for a particular investment, or all investments

in a particular sub-portfolio. Which columns are displayed

can be customized, and transactions may be filtered. [read more] |

| Filtering Examples |

| Reports in Fund Manager can be listed, filtered, sorted, and

sub-totaled in a wide variety of combinations to get the data

you need. Two examples are shown above. These

reports are showing the total shares of Intel owned by each

client, and then a breakdown of each one of the open lots of

Intel. These reports

can be used by advisors to quickly see how many shares of a

given security are owned by each client. The first report

is a custom report being filtered by the symbol INTC. The

second report is an Open Lots report, also being filtered by the

symbol INTC. The Advisor version also

allows all of the headers to be completely customized, including

support for mail merge fields. This allows client specific

information such as name or tax ID to automatically be inserted

in the report headers. |

|